Dear Micron Stock Fans, Mark Your Calendars for September 23

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

The race to dominate artificial intelligence (AI) continues to fuel the semiconductor sector, yet attention has shifted toward a company often overlooked by the broader market. While tech giants have dominated headlines, Micron Technology (MU) has quietly strengthened its foothold in the rapidly expanding AI and data center markets.

Micron’s momentum has been notable. In the second quarter of 2025, it surpassed market expectations, demonstrating robust demand for its memory and storage products. With the next quarterly results scheduled for Sept. 23, confidence among investors has grown markedly.

On Aug. 28, Micron announced the upcoming date for its fiscal fourth-quarter and full-year earnings conference call. The announcement spurred a 3.6% intraday rise, adding fuel to MU stock's rally. MU stock has also seen a 17% gain over the past five trading sessions.

As of this writing, MU hovers just shy of its 52-week high of $160.34, signaling that the market recognizes Micron's potential. As the AI sector continues to expand, the company may be positioned to attract investors seeking opportunities beyond the familiar tech giants.

About Micron Stock

Headquartered in Boise, Idaho, Micron has long been a stalwart in memory and storage solutions. Its portfolio spans high-performance dynamic random-access memory, NAND, and NOR products under the Micron and Crucial brands. With a market capitalization of $176 billion, the company addresses the needs of AI, cloud computing, and compute-intensive applications.

MU stock has experienced impressive momentum climbing 82% over the past 52 weeks, Meanwhile, its year-to-date (YTD) gains have accelerated to 89%. The past month alone has seen a 31% rise, underlining the intensity of market interest.

Despite the growth, MU stock trades at 12.58 times forward adjusted earnings, below both the industry average and its five-year historical multiple, presenting an attractive valuation opportunity.

Micron also maintains a modest annual dividend of $0.46, translating to a yield of 0.29%. Its most recent quarterly payout of $0.12, was distributed on July 22 to shareholders of record as of July 7.

Micron Surpasses Q3 Earnings

On June 25, Micron announced its third-quarter results for fiscal 2025, delivering a performance that could only be described as a bonanza for the memory chip manufacturer. Revenue soared 37% year-over-year (YOY), reaching $9.3 billion and comfortably surpassing Wall Street forecasts of $8.8 billion.

DRAM revenue climbed to $7.1 billion, marking a 51% increase compared to the prior year and accounting for 76% of total revenue. Meanwhile, NAND flash memory revenue rose 4% to $2.2 billion, representing 23% of the company’s overall sales.

The Compute and Networking business unit delivered a record quarter, generating $5.1 billion in revenue, up 11% sequentially. The strong showing was driven by a nearly 50% sequential increase in High Bandwidth Memory (HBM), along with steady growth in high-capacity DRAM and low-power server DRAM. The surge in HBM reflects the booming demand for memory solutions powered by AI applications, positioning the company at the forefront of a rapidly expanding market.

Non-GAAP net income rose 210% to $2.2 billion, while adjusted EPS grew 208% to $1.91, comfortably beating the Wall Street consensus of $1.59. Adjusted free cash flow exceeded $1.9 billion, marking the highest quarterly total in over six years.

Management’s guidance update on Aug. 11 further fueled investor optimism, lifting MU stock 4.1% intraday. Previously, the company had projected fourth-quarter fiscal 2025 revenue of $10.7 billion ± $300 million, non-GAAP gross margins of 42.0% ± 1.0%, and non-GAAP EPS of $2.50 ± $0.15. The revised outlook now sets revenue at $11.2 billion ± $100 million, non-GAAP gross margins at 44.5% ± 0.5%, and non-GAAP EPS at $2.85 ± $0.07.

On the other hand, analysts anticipate Q4 fiscal 2025 EPS to grow 170% YOY to $2.67, with the full fiscal year 2025 bottom line projected to surge 1,165% to $7.34. Momentum is expected to continue into fiscal 2026, with EPS estimated to increase 70% from the prior year to $12.50.

What Do Analysts Expect for Micron Stock?

Analysts have embraced Micron’s momentum with a bullish outlook. Citigroup analyst Christopher Danely raised his price target from $150 to $170 while maintaining a “Buy” rating, projecting results in line with management guidance and slightly ahead of Wall Street estimates, supported by higher DRAM and NAND pricing. JP Morgan analyst Harlan Sur also set a new price target of $185, highlighting strong optimism in the AI memory chip market.

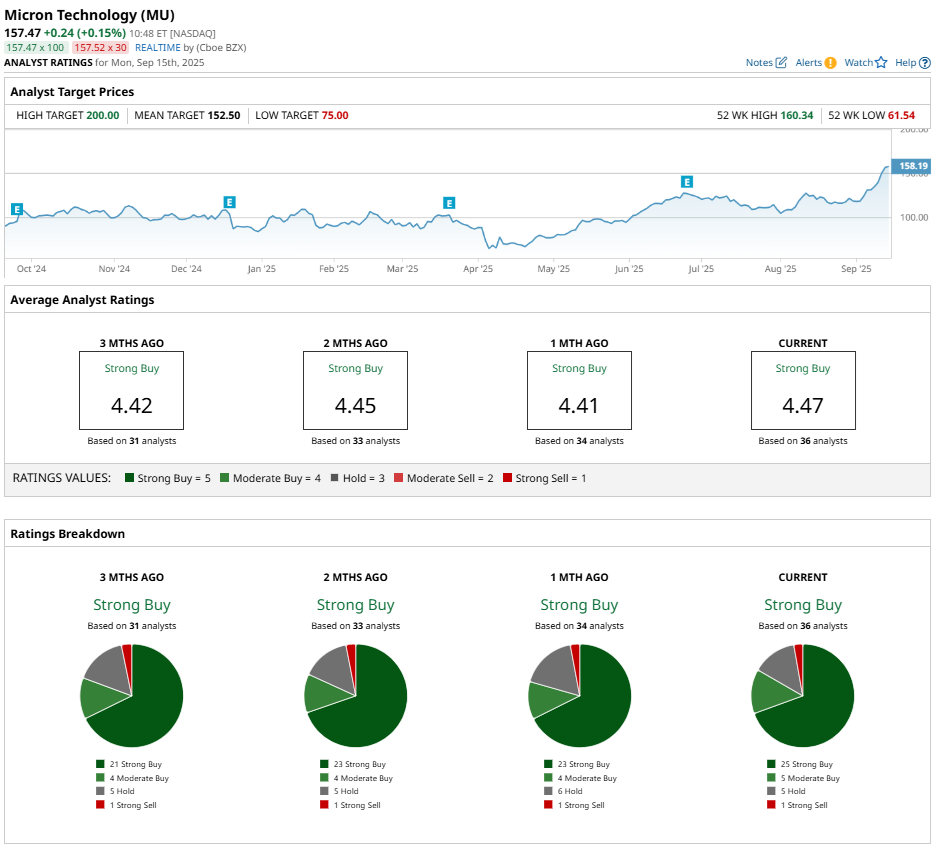

The broader analyst community reflects confidence by assigning MU stock a “Strong Buy” consensus rating. Among 36 analysts covering MU, 25 recommend a “Strong Buy,” five suggest “Moderate Buy,” five rate it a “Hold,” and one analyst assigns a “Strong Sell" rating.

MU stock is already trading above its average price target of $152.50. Meanwhile, the Street-high target of $200 reflects a 26% potential gain from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.