Chart of the Day 9/17/25: Before the Fed, Mind the Curve

The Federal Reserve will announce its latest decision on interest rates in just a few hours. Before that happens, let’s take one last pre-Fed look at the Treasury yield curve. Why? Because you can learn a lot about what markets are “thinking” by how it has changed over time.

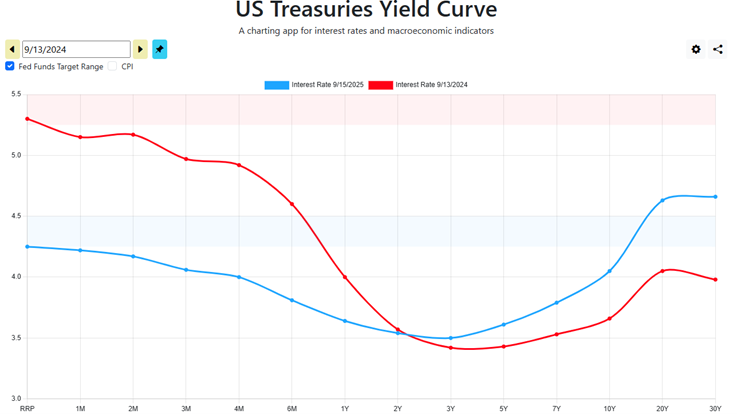

Take a look at the MoneyShow Chart of the Day below. It shows what the curve looked like in mid-September 2024 in red…and what it looked like yesterday in blue.

Source: www.ustreasuryyieldcurve.com

(If you want to get more articles and chart analysis from MoneyShow, subscribe to our Top Pros’ Top Picks newsletter here)

You can see that the curve was deeply “inverted” in September 2024, with short-term rates like the federal funds rate and Treasury bill yields much higher than long-term ones. But you can see that those short rates have plunged in the past year as Fed rate cut activity and expectations have ratcheted up.

What else is noteworthy? The changing shape of the curve! Yields on 10-year, 20-year, and 30-year Treasuries are now even with or higher than short rates. And if the Fed not only cuts today, but also follows up with one, two, or three more cuts in the next few months, that trend will likely get more pronounced.

What’s the “message” here? The “Run in Hot” trade in stocks and gold is also apparent in bonds. Bonds are pricing in a world where monetary policy gets more stimulative NOW...and that leads to more inflation risk LATER. Expansionary fiscal policy and the increased politicization of the Fed is also playing a role in this curve shift.

My prescription for how to trade it remains the same: Play it in futures, options, curve-sensitive equities, precious metals, or whatever you’re comfortable with. Because I suspect that no matter WHAT the Fed does or says in a few hours...and no matter what IMMEDIATE wild market action we see in response…the steepening trend isn’t over in the long term. Not by a long shot!