Canada’s Rail Titans: A Historical and Financial Comparison of CN and CPKC

Earliest Rail Adoption in Canada

Canada’s first railway was completed in 1836, backed by John Molson and other Montreal merchants, connecting Champlain and the Saint Lawrence from Montreal to Saint John (now Saint-Jean). The rail line carried little freight and acted more as a portage between the two rivers – expediting travel to New York - and remained Canada’s only public railroad for about a decade.

Serious construction of railways did not occur in Canada until the 1850s, including the St. Lawrence and Atlantic Railroad, completed in 1953, which provided Montréal access to an ice-free Atlantic port through Portland, Maine. Upon completion the Canadian section was sold, and the American section leased, to the Grand Trunk Railway.

Railway Mania

Railways began to dominate public policy, including the Guarantee Act of 1849, which allowed railways over 120 km to be eligible for a government grant that guaranteed interest of up to 6% on half its bonds once half of the railway had been completed. Several railways received assistance under the Guarantee Act, most notably the Great Western, the St. Lawrence and Atlantic, and the Ontario, Simcoe and Huron.

The Municipal Lein Act of 1952 also benefited railways by clarifying the extent to which municipalities could impose property taxes on railway infrastructure, potentially limiting the financial burden on railway companies.

Railway building became a mania in Canada with the positive legislation and led to an increase in the amount of track from 106 km in 1850 to more than 3200 km in 1860. Opening settlement in the West and playing an important role in the expansion of Confederation.

Consolidation of Canada’s Rail Network

The ease of capital through government assistance led many railway companies to overextend themselves, setting the stage for consolidation between the two primary Canadian railway companies that we know today, Canadian Pacific Railway (CP.TO) and Canadian National Railway (CNR.TO).

Canadian Pacific Railway (CP.TO) was incorporated in 1881 with its original purpose of constructing the transcontinental railway. The transcontinental railway was completed in 1885 and connected Eastern Canada to British Columbia and played an important role in the development of the nation. Between 1899 and 1913, CP increased its trackage from approximately 11,200 km to 17,600 km. The company also established hotels, shipping lines and airlines, and developed mining and telecommunications industries, but later separated into five independent companies in 2001, with Canadian Pacific Railway returning to its origins as a railway company.

Canadian National Railway (CNR.TO) was formed by the government of Canada between 1917 and 1923 and consolidated the failing Grand Trunk Pacific (which acquired the St. Lawrence and Atlantic railway), Canadian Northern, Intercolonial and Canadian Government Railways. CN also competed with CP in hotels, telegraphs, steamships and express services as well as railway services but began divesting its non-rail businesses in the 1970’s, including Air Canada and Via Rail (CN’s passenger train subsidiary).

In November 1995, CN was privatized and sold to investors due to the continual need for expansion capital as well as the economic recession of the 1980s. In February 1998, CN purchased US rail company Illinois Central Corporation for US$2.4 billion. The acquisition of Illinois Central expanded CN’s rail network to a third coast, the Gulf of Mexico. CN later acquired Wisconsin Central (2001), the rail and marine holdings of Great Lakes Transportation (2004), shares of BC Rail (2004), and the Elgin, Joliet & Eastern Railway (2009).

This consolidation across North America continues to this day, including CP’s recent acquisition of Kansas City Southern (KCS) for US$31 billion in 2022.

The fierce competition between CN and CP can be appreciated through the battle for KCS, where CN outbid CP’s initial offer by $5 billion just one month later. However, CN’s offer was blocked by the US Surface Transportation Board (STB) for anti-competitive reasons, which led to the final purchase going to CP for a few billion over its initial bid. Once the acquisition was complete, CP changed its name to Canadian Pacific Kansas City Limited (CPKC).

Fundamental Comparison of CN & CPKC (Q2 2025)

Today CN engages in the rail and related transportation business and operates a network of 20,000 miles of track and 23 terminals spanning Canada and the United States. While CPKC – following the Kansas City acquisitions - now operates a network of approximately 20,000 miles in Canada, the U.S. and Mexico.

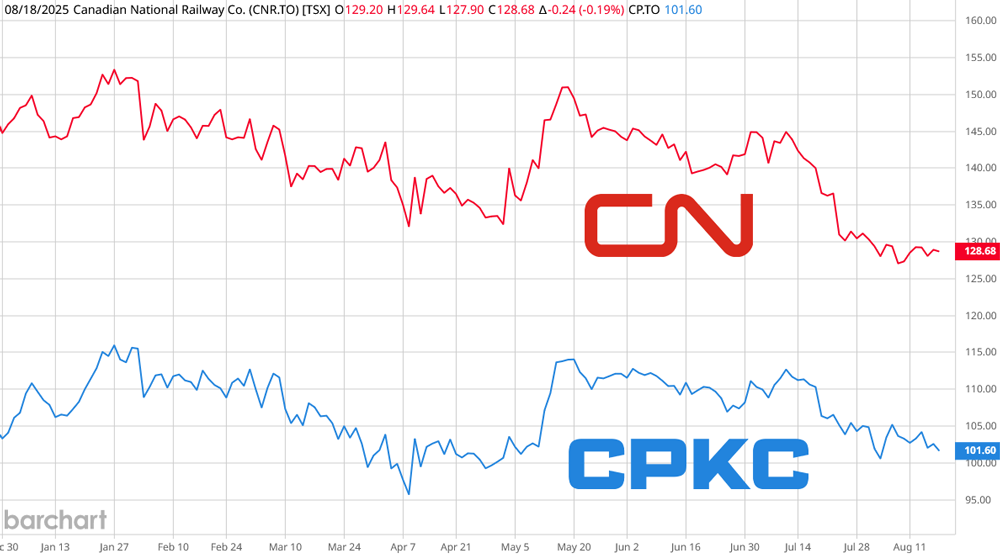

Share Price Performance

Looking at their share price performance over the past two and a half years, CN has underperformed comparatively, down around 20% from the beginning of 2023, while CP is down just half of one percent.

The relative underperformance from CN is likely due to CPKC producing better revenue and earnings growth, led by superior geographic exposure across North America and the integration benefits of KCS.

Revenue and Earnings

Looking at the most recent quarter (Q2 2025), CN’s consolidated revenue was down 1.3% with Grain & Fertilizer offsetting some of the decline, as it was the only product which was up. CPKC produced revenue growth of 3% in the quarter, producing similar strength through Grain, but also increases in its Coal, Energy, Chemicals & Plastics.

Earnings and Free-Cash-Flow were also points of strength for CPKC, up 37% and 15%, respectively, in the quarter. While CN produced EPS growth of 7% and a Free-Cash-Flow decline of approximately 3%.

Balance Sheet

CN does possess the superior balance sheet, with net debt of $20.5 billion and a trailing net debt-to-EBITDA multiple of 2.4 times. While CPKC has net debt of $21.5 billion and a trailing net debt-to-EBITDA multiple of 2.8 times.

2025 Guidance

CN is guiding toward Revenue Ton Miles (RTM) – which is calculated by multiplying the weight of cargo transported by distance travelled – to be up in the low single digit range, while Adj. EPS is expected to be up in the Mid single-digit to High single-digit range (which is down from its previous EPS guidance of 10%-15% growth). The downward revision following the Q2 results were due to revised volume assumptions, as on again, off again tariffs are forcing customers to rethink their supply chain. As well as a higher Canadian dollar assumption for the balance of the year.

CPKC is looking toward Mid-Single Digit RTM growth, with Adj. EPS to be up 10-14%. The company reiterated its guidance following the Q2 2025 results and indicated that they remain confident to deliver on their full-year guidance despite undeniable trade uncertainty and macro issues. Believing that the synergies (from KCS) are what’s driven its differentiated growth these last couple of years.

Valuation

On a valuation basis, CPKC is trading at a premium across all metrics likely given its better projected growth and recent execution. However, CN is trading at a historical discount on a trailing Price-to-Earnings basis, while CPKC is trading at a premium to its historical 10-year median.

Dividend

From an income investment perspective, CN is likely the better dividend growth stock having grown its dividend at a better pace over the past several years, now with a current dividend yield 2.8%, while CPKC’s is just 0.8%.

CPKC’s dividend has been flat over the past 5 years, apart from its last quarterly dividend paid in June increasing 20% to $0.228 per share.

But with the higher dividend yield, CN’s payout ratio is also higher, with a forward Dividend payout ratio from adjusted earnings of 47%, while CPKC’s is just 19%.

Seeing CPKC’s recent dividend increase along with its low payout ratio is promising, as the business could be back on a trajectory of regularly growing its dividend now that it has received the benefits of integrating KCS.

Conclusion

CPKC has been the superior investment over the past few years given its successful integration of KCS, which has led to better geographic diversification, growth, and elevated valuation multiples.

From an income perspective, CN is more appealing with better historical dividend growth, a higher current yield and healthy payout ratio. But seeing CPKC’s recent dividend increase of 20% is intriguing as the business may be back on a trajectory of regularly growing its dividend, and its low payout ratio provides ample room for dividend growth.

From an operating standpoint, it is reasonable for investors to pay up for the robust growth of CPKC, which management believes will persist throughout the second half of the year despite headwinds. But the elevated valuation is a risk. Alternatively, CN has been forced to reduce their guidance which has led the business to trade at discount to its historical valuation multiple.

If one is looking for exposure to the North American Rail industry, both CN and CPKC are solid options. One looking for a better dividend yield may opt for CN, while those who are looking for better growth and diversification across North America – despite a pricier valuation - could look toward CPKC. But it would be perfectly reasonable for a long-term investor to allocate half of a position to both names in order to benefit from the higher dividend yield of CN along with the better growth outlook from CPKC.

Yield alone isn’t enough. KeyStone's research helps you cut through the noise and build a smarter, profitable portfolio. Join Our Upcoming Live 10x Webinar