As Tesla Turns Positive for 2025, Should You Buy TSLA Stock?

Tesla’s (TSLA) 2025 journey has been anything but smooth. The year began on a sour note, with the electric vehicle (EV) stock logging its worst quarter since 2022, battered further by President Donald Trump’s tariff shock in April. Sentiment soured as sales lagged, competition from China tightened, and Musk’s political moves drew sharp backlash.

Yet just as the story seemed stuck in reverse, momentum flipped. TSLA stock turned green for 2025, surging double digits from April lows, fueled by CEO Elon Musk’s headline-grabbing $1 billion stock buy and fresh optimism around robotaxis, humanoid robots, and the fast-growing MegaBlocks battery business.

Wall Street has started to warm up again, with analysts praising Musk’s pay plan and pointing to long-term upside, even as near-term demand challenges linger. Wall Street loves a comeback, and Tesla has delivered one for the second year in a row.

Still, Tesla remains a laggard among tech’s mega-caps in 2025. Even after clawing back into positive territory, with aging EVs, shaky demand, and unproven bets on robotaxis and humanoid robots, should investors really buy TSLA stock now?

About Tesla Stock

Headquartered in Texas and boasting a market capitalization of more than $1.35 trillion, Tesla has evolved from an ambitious EV maker into a global powerhouse redefining transportation and energy. Guided by CEO Elon Musk’s relentless vision, the firm blends electric mobility with battery storage, clean power, and even robotics. A member of the “Magnificent Seven," Tesla doesn't just follow innovation but drives it, redefining mobility and infrastructure while keeping the world’s eyes fixed on its next bold move.

Tesla has stumbled through 2025, weighed down by cooling EV demand, tariff headwinds, and Elon Musk’s polarizing spotlight. Yet in classic Tesla fashion, the story flipped overnight.

Elon Musk just lit a fresh fire under Tesla stock. Fresh off securing a jaw-dropping compensation package that could be worth up to $1 trillion, Musk opened his wallet for the first time in five years — scooping up 2.57 million shares for about $1 billion. The insider buy, disclosed in a U.S. Securities and Exchange (SEC) filing, jolted the market as the EV stock erased year-to-date (YTD) losses. Peaking near $428.31 on Sept. 17, TSLA has seen a blistering 99% rebound from April’s low of $214.25. The stock is now up nearly 87% over the past 52 weeks and 79% in just six months.

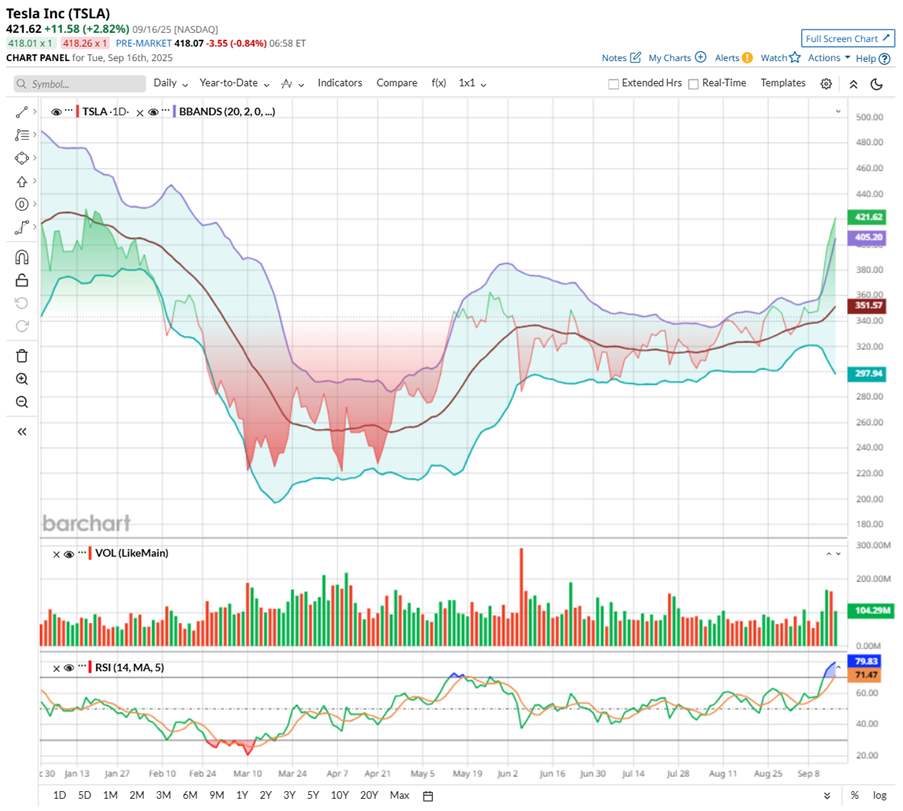

Still, the chart flashes caution. Tesla trades well above its upper Bollinger Band, a sign the stock is overextended relative to recent trends. Meanwhile, the 14-day RSI has surged to 79.83, the most overbought reading of the year. The momentum is undeniable, but such extreme technicals often precede cooling periods or pullbacks. Investors must now weigh Musk’s billion-dollar vote of confidence against technical signals hinting at a breather.

A Closer Look At Tesla’s Q2 Results

Tesla’s second-quarter 2025 earnings report landed on July 23, and the market’s reaction was anything but cheerful. After the closing bell, the EV giant revealed a miss on the bottom line, while edging past on revenue. Revenue came in at $22.5 billion, down 12% year over year (YOY), while EPS declined 23% annually to $0.40.

Deliveries fell sharply, down 13.5% YOY to 384,122, underscoring the pressure from an aging lineup and stiff competition out of China. Automotive revenues tumbled 16% YOY, with regulatory credit sales nearly halving, exposing just how reliant Tesla remains on those one-off boosts.

Margins, however, offered a silver lining. At 17.2%, gross margins beat expectations despite a $300 million tariff hit, thanks to efficiency gains in the revamped Model Y. Liquidity also looks solid, with $36.8 billion in cash and investments. But free cash flow cratered to just $146 million from $1.3 billion a year ago, highlighting rising capital intensity.

On the earnings call, Musk struck his familiar mix of caution and ambition. The CEO admitted that macro headwinds are biting hard, and Tesla essentially walked back 2025 delivery guidance. At the same time, Musk doubled down on vehicle autonomy and humanoid robotics, predicting unsupervised FSD later this year and mass production of Optimus within five years. He also pressed for higher voting rights and floated Tesla’s ultimate destiny as the world’s most valuable company.

The outlook painted a company caught between near-term turbulence and long-term moonshots. Management says it has the liquidity to fund its roadmap and still sees growth ahead in energy and autonomy. But with vehicle demand under strain and policy shifts cutting into incentives, it may be a bumpy road.

Analysts tracking Tesla predict the EV company's earnings dipping hard in 2025, with EPS sliding 41% YOY to $1.20. However, the comeback could be quick, with forecasts pointing to a solid 67% annual rebound, lifting EPS to $2 by fiscal 2026.

What Do Analysts Expect for TSLA Stock?

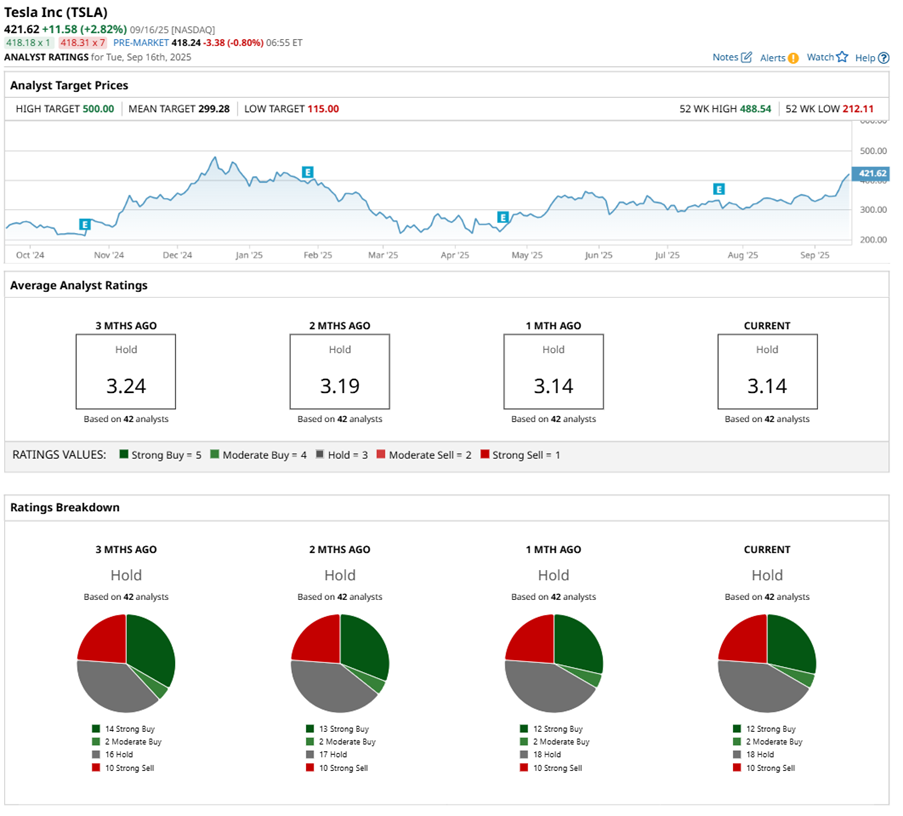

Wall Street’s take on Tesla is anything but unanimous. Some analysts are pounding the table, while others are waving the caution flag. TSLA stock has a “Hold” rating overall. Of the 42 analysts covering the stock, 12 recommend a “Strong Buy,” two have a “Moderate Buy,” 18 suggest a “Hold,” and the remaining 10 have a “Strong Sell” rating.

While the EV stock is currently trading above its mean price target of $299.28, Wedbush's Street-high target of $500 implies potential upside of 17%.

Tesla’s comeback this year feels like watching a movie — one thinks Tesla is down for the count, then Musk pulls a billion-dollar plot twist. TSLA stock is ripping, no doubt, but it's also looking stretched, and the core EV business is still shaky. Long term, the upside is real if robotaxis and robots deliver. For now, though, Tesla is equal parts adrenaline rush and risk.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.